3 Ways to Make Money in a Stock Market Crash

A common man believes that "when stock markets reach the peaks, every investor and trader make money and when the market tumbles, everyone loses their hard earned money."

That's why I had to face many sympathetic looks, whenever the market goes down. Most of my friends, neighbors, enemies (in the disguise of friends) show their sympathy with looks or words.

But the ultimate secret that is only known to regular investors and traders is...

"You can make money in the Stock Market crash too".

You can Make unlimited profits with limited risk with some proven strategies.

Every day a huge number of traders make their living by trading in market dips.

1. For Investors:

The simple and most valuable rule for investors is

"Start buying in small quantities"

When the markets fall, every trader who has long positions gets panicked. Their stop losses triggered, positions are squared off automatically by brokerage firms.They hurry to cover their losses. These chaos lead to more market fall.

These could be a golden opportunity for every long term investor.

Here, don't go for penny stocks. In a market crash. the fundamentally attractive blue chip stocks, mid cap stocks having good momentum are available at attractive prices. but don't be hasty. Just start buying scrips (preferably market leaders) in small quantities. Buying in small quantities gives ample opportunity to buy more if the market goes down further.

So, what could you do?

Whenever there is an anticipation of market crash, keep yourself ready with liquid cash, and start investing when the time ripens.

How can you predict a market crash?Which factors affect Stock market's momentum?

Here are some factors which affect the indices.

- Global markets

- Political uncertainty

- FII's (Foreign Institutional Investors)

- Monetary Policy (Of central Bank)

- International political scenario (wars etc)

- rules and regulations imposed by the Government.

If you want to become an active investor, you need to know how all these factors influence the market.

For traders:

2. Selling short: (In Futures)

In derivatives, taking a short position is a method when we expect a market crash.When a trader feels bearish about the market and believes it certainly goes down, then he takes a short position. If the market tumbles as he predicted, then he makes money. Otherwise he gathers huge losses.

If you want to quit your position, you need to square off your position and be happy with what you gained or lost.

Risk factors:

1. Going short is a position in futures segment in Derivatives. It has unlimited risk and unlimited reward ratio. You may make huge profits or huge losses. Hence, If you can bear this , then only take a position. Otherwise keep away from it and choose other methods mentioned in this blog post.

2. Market fluctuations are very sharp and extremely unpredictable.

When many other investors have short positions, if they try to cover their short positions, they have to buy and eventually market goes up. You may be left with big losses.

For traders:

3. Buying a Put option:

If you are reluctant to "high Risk Reward situation" this method can be useful.

This is a method with "Limited risk- Unlimited reward ratio".

Now,

What is a Put option?

Investments in Stock market are of two types.

1. Equities: Buying and selling individual stocks of companies.

2. Derivatives: Speculating on stocks (Just like betting). Predicting the prices would rise or fall with time.

Again Derivatives are divided into

1. Futures : Speculating on individual stocks or market indices like NASDAQ or Nifty. It has

Extreme Risk Reward ratio.

2. Options : Also a kind of speculation, with Limited risk unlimited Reward ratio.

It can also be traded on individual stocks or market indices.

If you are a beginner, you may have a simple question in your mind "When options trading has limited Risk- unlimited Reward ratio, why don't everyone go for it?"

It can be explained.

Yes, it has limited Risk- unlimited Reward ratio, but the probability to get unlimited reward is low. If you want to make big profits in Options, you need to find huge market moves like great rally or market crash.

Finding these kind of situations everyday is highly unlikely. And when there is no clear trend visible in the markets you end up losing your investment in options.

The expiration day for Nifty option is the last Thursday of Contract month.

How does a Put option work:

Before going to understand the mechanism behind Put option, One simple thing...

"Never intimidated by Stock Market jargon"

In the beginning you might be puzzled by those terms, but gradually you get habituated to it.

Most important thing is don't skip, when you find those terms. Just focus and understand.

How does a put option work?

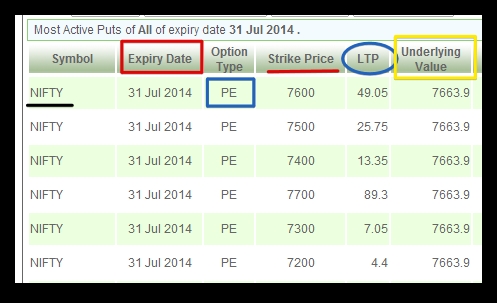

Now look at this data.

This is a chart of available nifty put options.We want to buy one, so just examine what are those terms.

In the chart we can see six different Put options are available with six different strike prices.

Strike price is our target.

Expiry date for all the six Put options is the same, that is 31st July. All derivatives (futures, Put options, Call options) expire on last Thurs day of every month.

PE means Put Option European style settlement.

LTP means Last Traded Price. The last transaction on that particular Put option was exercised at that price.

Underlying Value means the value of the indices. That is Nifty is trading at that point.

When a trader feels market would collapse, he buys a put option

Now from the above chart, if he buys 7600 Put option his investment would be

49.05 x 100 = 4905 Rupees. (100 is the lot size of Nifty options)

Now let us see what happens on the expiration date.

- If Nifty closes below, as he expected, at 7425

he would profit the difference between strike price and nifty closed price on expiry date.

That is 175 X 100 = 17500 (100 again lot size)

If we deduct the investment, 17500 - 4905 = 12595.

The trader makes a profit of 12,595 Rs.

- If nifty closes above the strike price

He doesn't make any money and loses the investment he made, that is 4905 Rs.

This kind of Put is called Naked Put or Uncovered Put.

Disclaimer:

Investing involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. Nothing contained herein should be construed as a warranty of investment results. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. You should take a professional financial consultant's advice.